THANK YOU FOR SUBSCRIBING

The Opportunity for 5G-Advanced to Shape Enterprise Applications

Jake Saunders, Asia-Pacific VP, ABI Research.

Jake Saunders, Asia-Pacific VP, ABI Research.

Businesses and enterprises implement new technologies for a number of reasons:

To improve productivity, to reduce total cost of ownership (i.e., Capital Expenditure (CAPEX) and Operational Expenditure (OPEX)), to better meet the needs of their customers, to improve health and safety compliance, and/or to improve their competitive advantage. Wireless technologies like 5G enable digital transformation because they “free up” equipment and personnel, and enhance the “contextual” (e.g., monitoring environmental conditions) and “performant” (e.g., increasing routing efficiency of autonomous guided vehicles on a factory floor) analytics of an enterprise’s process or product.

Several wireless technologies are jockeying for position—Wi-Fi, Bluetooth, Low-Power Wide Area Network (LPWAN), DECT NR+, and The 3rd Generation Partnership Project (3GPP) Long Term Evolution (LTE), and, most recently, 5G. Many of these wireless technologies complement each other, serving different enterprise requirements in different operational domains. However, 3GPP’s wireless technology roadmap has been effective in balancing the introduction of new innovations versus consensus-building standardization to improve wider adoption.

5G Is Maturing

5G already has several features for the enterprise customer:

• Connectivity of up to 1 million devices per Square Kilometer (km2) to enable highly dense wireless sensor networks for monitoring.

• Supported bandwidth of uplink 10 Gigabits per Second (Gbps), downlink 20 Gbps to empower data-intensive processes.

• Guaranteed network reliability of sub-10 Millisecond (ms) latencies to make industrial 5G fit for real-time applications.

Figure 1. Key Features of 5G Classic

5G enterprise applications are being trialed and deployed in a number of markets around the world. The Asian market, in particular, is witnessing a hotbed of activity.

Enterprise verticals that are anticipated to benefit from 5G include manufacturing and logistics. Key use cases in manufacturing relate to the implementation of real-time robotic control for remote-controlled operations, autonomous vehicle operations, Extended Reality (XR) technology for training and support applications, as well as massive data sensor collection to support the development of digital twins for quality control purposes. In the area of logistics, key use cases for 5G adoption include vision-based inspections for autonomous and/or remote-controlled operations, asset tracking, and smart transport applications. A suitable logistics 5G-to-Business (5GtoB) use case sample can be seen in China where China Mobile Zhejiang, Huawei, and a group of partners have worked with the Ningbo-Zhoushan Port operator, Zhejiang Provincial Seaport Investment and Operations Group, to implement a 5G network for real-time asset inspection and tracking, remote and automated operations of Rubber-Tired Gantries (RTGs), and container truck fleets.

Beyond the above mentioned two verticals, remotely operated and semi-autonomous vehicles will also be able to significantly improve efficiencies in mining and Oil and Gas (O&G) facilities, where the workplace environment tends to be challenging. Machine vision can be used for inspecting equipment and personnel.

An example of a natural resources 5GtoB implementation can be seen in Indonesia where PT Freeport Indonesia partnered with Telkomsel to launch a 5G smart mining application where machinery and vehicles in underground mines could be controlled remotely.

Enterprises in Asia are starting to figure out how to harness 5G and integrate it into their operational processes. In the private 5G cellular sector, manufacturing is expected to benefit significantly from 5GtoB. Equipment and services spending is expected to grow from $141 million in 2022 to $5.1 billion in 2028. In the 5G public cellular networks domain, the logistics vertical is anticipated to witness equipment and services spending grow from $14.6 million to $3.4 billion over the same timeframe.

What Is Next for 5G?

5G is continuing to evolve and anticipate future requirements from enterprise customers. These include location triangulation enhancements that should enable “sub-1 centimeter accuracy” for indoor scenarios. The introduction of 5G-Advanced’s Sidelink Relay technology will allow a more flexible on-premises deployment approach. Device-to-Device(D2D) communications would mean 5G communications does not need to be routed through a base station, thereby supporting ad hoc network coverage extension. Further Sidelink enhancements will benefit Vehicle-to-Everything (V2X) data communication links for commercial and passenger vehicles. Reduced Capability (RedCap) will confer 5G capabilities onto power-constrained devices. These include smartwatches and other wearables, smart accessories, surveillance and machine vision cameras, Augmented Reality(AR)/Virtual Reality (VR) devices and Internet of Things (IoT) devices.

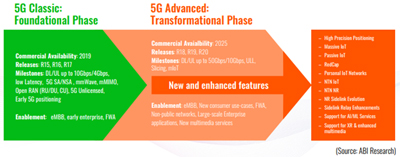

Figure 2. 5G Evolution across 3GPP Releases

The current 5G deployments will need to mature and prove themselves, but ABI Research expects 5G-Advanced will be commercially launched by 2025, 2 years after the planned freeze date of Release18. By 2030, ABI Research expects 75 percent of 5G base stations to be upgraded to 5G-Advanced, which would account for 76 million radios, 23 million macro basebands, and 13 million small cells being upgraded in the public cellular market. In the enterprise market, half of private cellular small cells are anticipated to be upgraded to 5G-Advanced, accounting for 14 million in 2030.

Weekly Brief

I agree We use cookies on this website to enhance your user experience. By clicking any link on this page you are giving your consent for us to set cookies. More info

Read Also